41 reverse triangular merger diagram

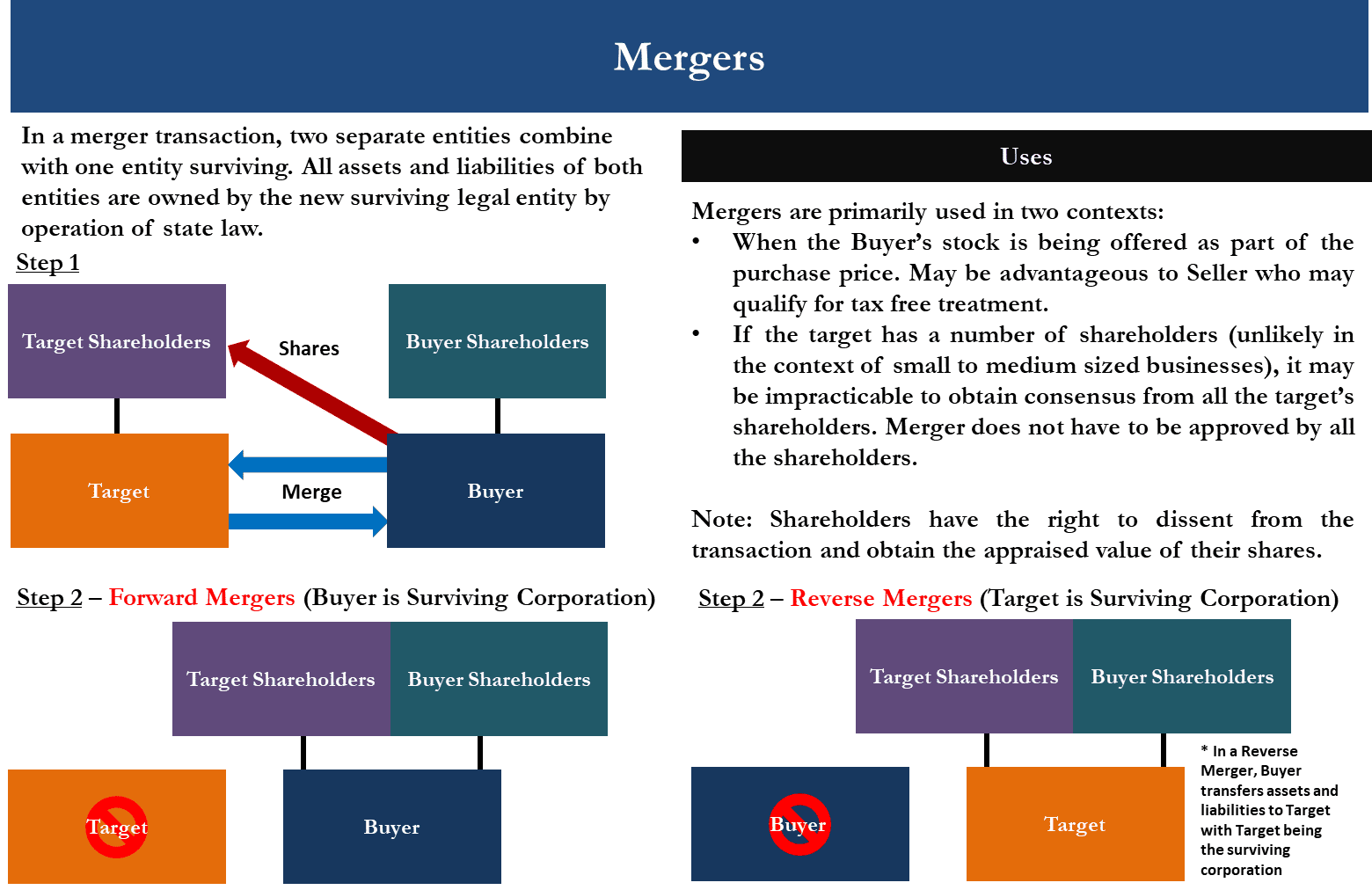

Essays Assignment - One assignment at a time, we will help ... One assignment at a time, we will help make your academic journey smoother. The triangular merger - LIME in a "reverse triangular merger" transaction, the target company acquires all assets and liabilities of the subsidiary of a parent company of the acquiring group, it being understood that the shareholders of said target company contribute in that context their target company's shares to the parent company, in exchange for shares of the parent …

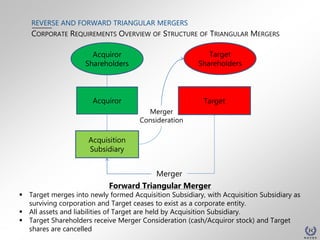

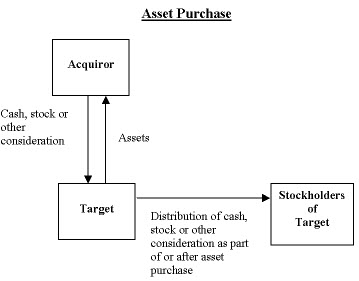

PDF Tax Considerations in Corporate Deal Structures "forward triangular merger." This form of reorganization is slightly more flexible than a reverse triangular merger. However, Target does not survive; consider 3rd party consents 5. If transaction is determined to be taxable, it is an asset sale by Target followed by a liquidation of Target (see prior discussion) (Merger Co. Survives) Acquiror

Reverse triangular merger diagram

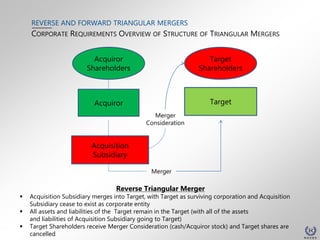

Reverse Triangular Merger | Practical Law Glossary Reverse Triangular Merger A form of merger in which: The buyer forms a subsidiary and that merger subsidiary merges with and into the target company. The target company assumes all of the merger subsidiary's assets, rights, and liabilities by operation of law. The merger subsidiary ceases to exist as a separate entity. Forward Triangular Merger Definition A reverse triangular merger is when the shell company is merged into the target company. Understanding Forward Triangular Merger Forward triangular mergers, like reverse triangular mergers, in... Reverse Triangular Merger - W I T N E S S E T H: A reverse triangular merger (also called a reverse subsidiary merger) is an acquisition structure where one company acquires another company using a subsidiary of the acquiring company. In a reverse triangular merger, a merger subsidiary of the acquiring company merges with and into the target company, with the target company surviving the merger.

Reverse triangular merger diagram. Reverse Triangular Merger: The Taxable and Tax-Free ... One of the reasons to pursue reverse cash or triangular merger is the ability to maintain the target company's legal status, which helps it preserve contracts and other nontransferable assets. Also, the transaction structure makes it easier to squeeze out minority shareholders or cash out options. What Is A Reverse Triangular Merger (Definition And Overview) Reverse triangular merger diagram Tax considerations Takeaways What is a Reverse Triangular Merger A reverse triangular merger is when an acquiring company uses a subsidiary to merge with the target company. Once the merger is completed, the target company remains the surviving entity while the acquiring company's merger subsidiary is dissolved. The World's Longest Diagramless - Massachusetts Institute of ... The World's Longest Diagramless Everything's bigger in Texas. In this diagramless crossword, Acrosses and downs have been merged into a single combined clue list in order of appearance. Light Rail (MTR) - Wikipedia This means that island platforms (except the triangular platform at Siu Hong stop) cannot be used at all in the LRT system and the termini have to feature loops for LRVs to reverse in direction. Phase I LRVs were built by Comeng and put in service in 1988. They are numbered 1001–1070 and accommodate 43 seated passengers and 161 standees.

2.10 Reverse acquisitions - PwC The merger of a private operating entity into a nonoperating public shell corporation with nominal net assets typically results in (1) the owners of the private entity gaining control over the combined entity after the transaction, and (2) the shareholders of the former public shell corporation continuing only as passive investors. PDF Structuring Reverse and Forward Triangular Mergers •In a reverse triangular merger, D&N Systems, Inc. merged with SybaseSub, Inc., and the surviving entity took the name SQL Solutions, Inc. Oracle Corporation sought to terminate its agreement with D&N Systems, which contained an anti-assignment clause requiring Oracle's consent for any assignment or transfer of the agreement to a third party. Triangular merger definition - AccountingTools A reverse triangular merger is the same as a triangular merger, except that the subsidiary created by the acquirer merges into the selling entity and then liquidates, leaving the selling entity as the surviving entity, and a subsidiary of the acquirer. Its characteristics are: At least 50% of the payment must be in the stock of the acquirer Demystifying International Forward and Reverse Tax-Free ... Reverse Triangular Mergers Before examining the tax consequences of a reverse triangular merger, the transaction itself must be explained. Suppose P desires to acquire the stock of T in a tax-free reorganization and keep T alive as a subsidiary, but P is unable to structure the deal as a Type B reorganization because of the "solely for voting ...

Type A Forward and Reverse Triangular Tax-Free Merger | SF ... Reverse Triangular Mergers Before examining the tax consequences of a reverse triangular merger, the transaction itself must be explained. Suppose P desires to acquire the stock of T in a tax-free reorganization and keep T as a subsidiary, but P is unable to structure the transaction as a Type B reorganization because of the "solely for ... Wiring Diagram Pictures - schematron.org Hampton Bay 52 Ant Pull Chain Switch Wiring Diagram. 28.05.2019 28.05.2019. 12 Volt Rv Wiring Diagram 2003 Newmar Kountry Star Reverse Triangular Merger Definition A reverse triangular merger, like direct mergers and forward triangular mergers, may be either taxable or nontaxable, depending on how they are executed and other complex factors set forth in... Benefits of Reverse Triangular Merger : Tax Article by Tax ... A reverse triangular merger is a type of merger plan used when forming or absorbing a company. Instead of following direct merger or forward triangular merger plans, this kind of a merger consists of the acquiring or parent company creating a subsidiary, which then goes on to purchase another company.

Newsletter Signup - Hollywood.com In subscribing to our newsletter by entering your email address you confirm you are over the age of 18 (or have obtained your parent’s/guardian’s permission to subscribe) and agree to ...

Brief Introduction to Corporate Inversions (With Diagram ... In a basic reverse triangular inversion, as illustrated in the corresponding diagram, U.S. shareholders transfer all of their stock to a US subsidiary corporation and receive foreign parent stock in return. U.S. parent corporation merges into foreign subsidiary with foreign subsidiary not surviving the merger.

Selling Your Company: Comparing Merger Structures | The ... A commonly used merger structure is the "reverse triangular merger." In a reverse triangular merger, the acquiring company will form a wholly-owned subsidiary company (a "merger sub"). When the merger transaction closes, the merger sub will be merged with and into the target company, with the target company surviving as a wholly-owned ...

Reverse Triangular Merger Type A Tax Free Reorganization ... This video discusses the format, requirements, and benefits of a reverse triangular merger. The reverse triangular merger is a Type A tax-free reorganizatio...

What Is a Reverse Triangular Merger? | Woodruff Sawyer What Is a Reverse Triangular Merger? A reverse triangular merger occurs when an acquiring company forms a subsidiary in order to purchase a target company, which then absorbs the subsidiary to create a new company. This differs from a reverse merger, which involves a smaller private company absorbing a larger publicly-listed company.

Assisting students with assignments online - Success Essays Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

REVERSE TRIANGULAR MERGER The advantage of this structure ... Download scientific diagram | - REVERSE TRIANGULAR MERGER The advantage of this structure is relevant in that the functional business remains intact (Adjei, Cyree and Walker 2008). The bank ...

LiveInternet @ Статистика и дневники, почта и поиск Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.

PDF Structuring Reverse and Forward Triangular Mergers Reverse Triangular Merger Target survives Traditional practitioners' view: no assignment, subject to exceptions (e.g. California-related reverse triangular merger may trigger anti-assignment and anti-transfer clauses in light of SQL Solutions v. Oracle) Change of control provisions may be triggered 23 ANTI-ASSIGNMENT CLAUSES IN TRIANGULAR MERGERS

University of South Carolina on Instagram: “Do you know a ... 13/10/2020 · 2,458 Likes, 120 Comments - University of South Carolina (@uofsc) on Instagram: “Do you know a future Gamecock thinking about #GoingGarnet? 🎉 ••• …

Wiring Diagrams Free - diagramweb.net DOWNLOAD Wiring Diagrams Free. Close DOWNLOAD. Wiring Diagram For Shunt Breaker In Fire Suppression System. More Details . Ez Pack Hercules Front Loader Light Wiring Diagram. More Details . 4 Gang 4 Load Toggle Wiring Diagram. More Details . New Holland 555e Wiring Diagram. More Details . Reverse Triangular Merger Diagram. More Details . Rj12 ...

Reverse Triangular Merger Diagram - schematron.org a reverse triangular merger occurs when an acquirer creates a subsidiary, the subsidiary purchases a target and the subsidiary is absorbed by.the reverse triangular merger a reverse triangular merger is the same as a triangular merger, except that the subsidiary created by the acquirer merges into the selling entity and then liquidates, leaving …

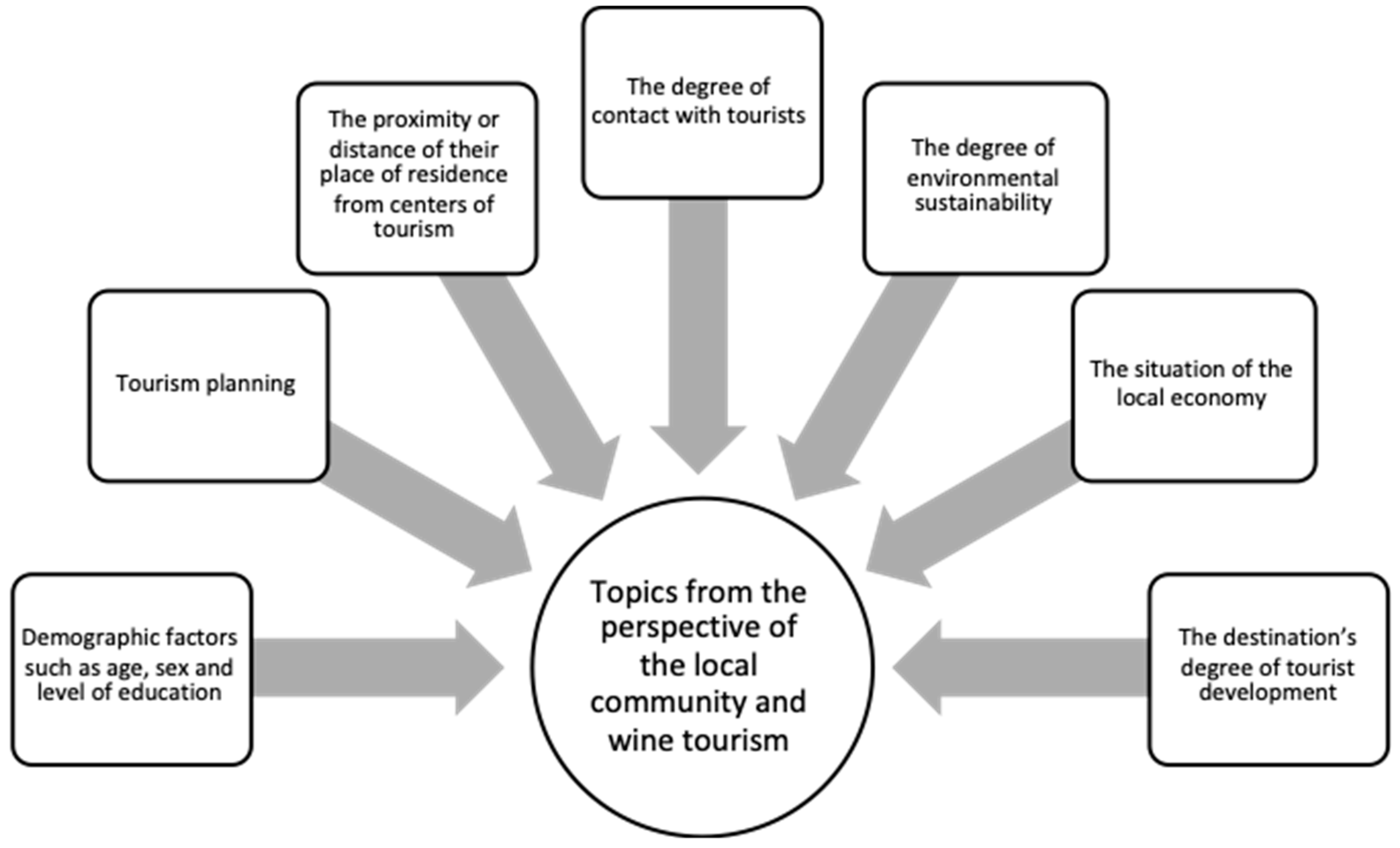

Basic Structures in Mergers and Acquisitions (M&A ... In an indirect merger, the target company will merge with a subsidiary company of the buyer. If the subsidiary of the buyer survives, this is called a "forward triangular merger." If the target company survives, this is called a "reverse triangular merger." The best way to explain these concepts is through the use of diagrams as shown ...

PDF Tax Aspects of Corporate Mergers and Acquisitions (iii) a reverse triangular merger of S into T, with T the survivor. As a result of this transaction, T becomes a wholly-owned subsidiary of P and T's shareholders receive cash, notes, or other taxable consideration (or a combination thereof).

Reverse Mergers - Sichenzia Ross Ference LLP Reverse Triangular Mergers One of the most common types of reverse merger is the reverse triangular merger. With this structure, Pubco incorporates a wholly-owned subsidiary (Merger Sub) in the jurisdiction of Privco. On closing, the holders of Privco exchange their Privco shares for shares in Pubco and Merger Sub is merged with and into Privco.

Fountain Essays - Your grades could look better! 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Forward Mergers vs. Reverse Triangular Mergers - CapLinked In a reverse triangular merger, at least 50% of the payment is the stock of the purchasing company and that company gains all the assets (and liabilities as well) of the target company — differentiating it from a forward triangular merger. Pros and Cons in a Reverse Triangular Merger The benefits of reverse triangular mergers are numerous.

(PDF) FLOW IN OPEN CHANNELS Third Edition - Academia.edu Academia.edu is a platform for academics to share research papers.

EAL TRUCTURES UNDER TATE AND FEDERAL AW - Miami There are "direct mergers," "triangular mergers," "reverse triangular mergers," "interspecies mergers," "mergers of equals," "short-form mergers," "squeeze-out mergers," etc. One should not let the overabundance of jargon in merger practice cause distress. All of the previously mentioned mergers are simply versions ...

Reverse Triangular Merger - W I T N E S S E T H: A reverse triangular merger (also called a reverse subsidiary merger) is an acquisition structure where one company acquires another company using a subsidiary of the acquiring company. In a reverse triangular merger, a merger subsidiary of the acquiring company merges with and into the target company, with the target company surviving the merger.

Forward Triangular Merger Definition A reverse triangular merger is when the shell company is merged into the target company. Understanding Forward Triangular Merger Forward triangular mergers, like reverse triangular mergers, in...

Reverse Triangular Merger | Practical Law Glossary Reverse Triangular Merger A form of merger in which: The buyer forms a subsidiary and that merger subsidiary merges with and into the target company. The target company assumes all of the merger subsidiary's assets, rights, and liabilities by operation of law. The merger subsidiary ceases to exist as a separate entity.

)

Comments

Post a Comment